Cari SWIFT Code

Temukan Kode SWIFT Bank

SWIFT Code:

Cek SWIFT Code Manual

Temukan Cek Kode Swift dengan Mudah

Negara:

Bank:

Kota:

SWIFT:

In an era of rapid technological development, financial transactions are becoming easier, not only at the national level but also on an international scale. Technology plays a key role in this convenience, especially through the use of Swift code which facilitates the smooth process of sending money between countries.

For many people, especially those who are not familiar with this term, understanding its usefulness is difficult. Swift code still somewhat unclear. Along with the development of technology, the banking sector also continues to advance, offering various facilities and products that make it easier for its users.

Transferring money between banks, both domestically and internationally, has become simpler, faster, and safer. This article will explain more about the importance of Swift code in facilitating international financial transactions.

What is Swift Code

Swift code is an abbreviation of Society for Worldwide Interbank Financial Telecommunications, which is used to facilitate the identification of banking or securities institutions in various countries or special branches. Generally, Swift codes consist of 8 or 11 characters, a combination of numbers and letters, although they can also consist of only letters.

For example, the Swift code for BRI Bank is BRINIDJA, where the first four letters reflect the identity of Bank BRI, the next two letters indicate the country code of origin, and the last two letters describe the location or branch code.

Interestingly, Bank BRI Indonesia's Swift code is unique, unlike other banks in Indonesia that only have one Swift code for their head office and branches. Bank BRI's Swift code for the head office is different from the Swift code for the branch offices.

When Do You Need Swift Code?

Swift code or BIC (Bank Identifier Code) becomes important in some international financial situations. When you are involved in an international interbank money transfer, either as a sender or recipient, the Swift code of the bank involved is required to ensure that the transaction can be carried out successfully.

In addition, when you make foreign exchange purchases or engage in global business transactions, Swift code is also an important component. In the use of international financial services or payment of bills or debts at the global level, having the correct Swift code information is a must.

Therefore, understanding when you need a Swift code is essential to ensure the smoothness and security of your overseas money transfer activities. Before engaging in an international financial transaction, make sure you have an accurate Swift code that matches the bank involved in the process.

Swift Code Functions

Swift Code created by SWIFT organization, aims to facilitate the exchange of information related to the financial industry between countries globally. Currently, more than 200 countries and more than 9 thousand securities and banking companies have joined the SWIFT association.

Apart from being known as Swift code, this code is also often referred to as Bank Identifier Code or BIC, referring to its main function in identifying financial institutions of a country so that it can make it easier for you to carry out international financial transactions.

Swift Code Example

Swift code or BIC (Bank Identifier Code) consists of eight or eleven alphanumeric characters. Here is one example of a Swift code, namely BCA (Bank Central Asia) with Swift Code, namely CENAIDJA.

Read Also: IBAN Code: Definition, How to Check and Differences

Please note that each bank has a unique Swift code, and the Swift code is used to identify the bank involved in the international financial transaction. Before making a money transfer, make sure you have the correct Swift code from the bank concerned.

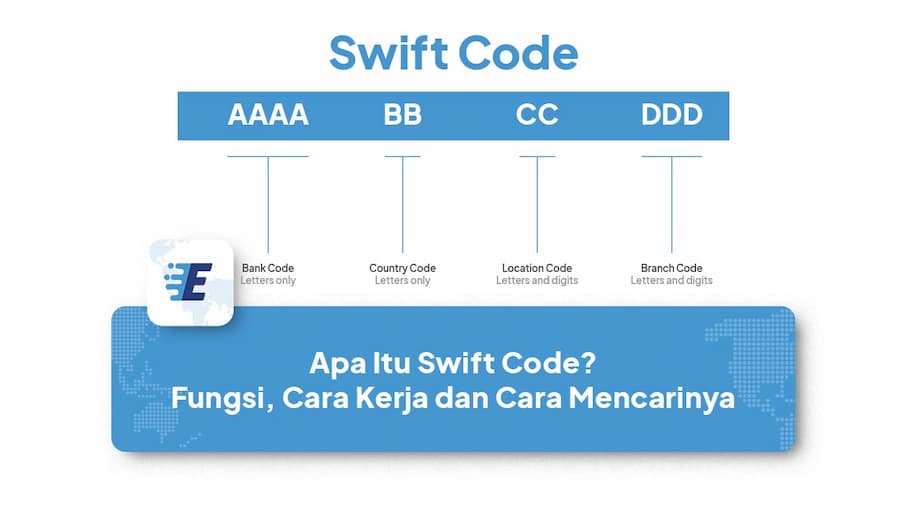

Swift Number/BIC Code Format

|

Swift Code Example |

|||

| AAAA | BB | CC | 123 |

| Bank Code | Country code | Location Code | Branch Office Code |

SWIFT code or BIC is a code with a length of 8-11 characters that provides information about the country, city, bank name and bank branch office.

- Bank codes A-Z consist of four letters that reflect the abbreviation of the bank name.

- Country codes A-Z consist of two letters that indicate the country location of the bank.

- The location code 0-9 A-Z consists of two characters, letters and numbers, providing information about the location of the bank's head office.

- The branch code 0-9 A-Z consisting of three digits or letters, is used to identify a particular branch office, with ‘XXX’ indicating the bank’s main office.

How Swift Code Works

The way Swift code works is very simple. For example, if you as a customer of Bank A in Japan want to send money to your parent's BRI Bank account in Jakarta, the first step you need to do is visit the Bank A office in Japan with detailed information such as your parent's account number and the BRI Bank Swift code, namely BRINIDJA.

Then, Bank A will send transfer instructions to Bank BRI Jakarta via the SWIFT system. After receiving a message from Bank A, Bank BRI Jakarta will continue the settlement process and transfer the money directly to the parent's account. It is important to remember that the swift code is a network of communication codes that only function as an intermediary in money transfer transactions between banks at the international level.

Read Also: What are Branch Codes? How to Find and Complete List

In other words, SWIFT codes do not have money or securities and are not responsible for managing customer account numbers. They are simply a communication tool that facilitates the process of transfers between banks globally.

How to Find Swift Code

To find the Bank Swift code, there are several methods that can be used, including the following:

1. Proof of Account Number Activity Report

Some banks often include Swift codes on monthly statements of customer account numbers. Checks can be made on documents, and if not found, the service mobile banking dapat menjadi alternatif.

2. Official Website of Banking Company

Swift codes are often listed on the front page of a banking company's official website. Although not all banks provide this information, users can search for Swift codes on the bank's official website or continue searching online.

3. Search Engine

Users can use the search engine with appropriate keywords, such as "Swift code Bank BRI" or "Swift code Bank BRI Syariah". The search results will display sites that provide information about Swift codes Bank BRI and Bank BRI Syariah.

List of Swift Codes for All Banks in Indonesia

Each bank has a different Swift Code, therefore you must ensure that the Swift Code you entered is correct. Here is a list of Swift Codes for all banks in Indonesia:

- BCA Swift Code: CENAIDJA

- BRI Swift Code: BRINIDJA

- Swift Code Mandiri: BMRIIDJA

- BNI Swift Code: BNINIDJA

- CIMB Niaga Swift Code: BNIAIDJA

- BSI Swift Code: BSMDIDJA

- Swift Code Bank Mega: MEGAIDJA

- Danamon Swift Code: BDINIDJA

- Swift Code of Niaga Bank: BNIAIDJA

- NISP Bank Swift Code: NISPIDJA

- Swift Code Bank Artha Graha: ARTGIDJA

- Swift Code Panin Bank: PINBIDJA

- BTPN Swift Code: SUNIIDJA

- Indonesian Syariah Bank Swift Code: BSMDIDJA

- Permata Bank Swift Code: BBBAIDJA

- Swift Code Maybank Indonesia: MBBEIDJA

- Swift Code UOB Indonesia: UOBBIDJA

- Swift Code DBS Indonesia: DBSBIDJA

- Swift Code for BRI Simpedes Bank: BRINIDJA

- Citibank Swift Code: CITIIDJX

- Swift Code Bank Muamalat: MUABIDJA

- Swift Code Bank Jago: JAGBIDJA

- Swift Code Bank Sinarmas: SBJKIDJA

- Hana Bank Swift Code: HNBNIDJA

- Bank Jatim Swift Code: BJTMIDJA

- Seabank Swift Code: SSPIIDJA

- Commerzbank Swift Code: COBADEFF

- Swift Code Bank DKI: BDKIIDJA

- Swift Code BTPN Jenius: SUNIIDJA

- Swift Code bank btn: BTANIDJA

- Swift Code cimb niaga syariah: BNIAIDJA

- Swift Code Neo Bank: YUDBIDJ1

- Swift Code vietcombank: BFTVVNVX

- Swift Code Dana: DANAUS33

- Swift Code Bank RHB Malaysia: RHBBMYKL

- Swift Code Bank OCBC NISP: NISPIDJA

- Swift Code BSI Syariah: BSMDIDJA

- Swift Code Bank Bukopin: BBUKIDJA

- Swift Code Bank Artos Indonesia: ATOSIDJ1

- Swift Code kasikornbank: KASITHBK

Conclusion

Swift code is one of the important roles for you when you want to make transactions abroad. However, it should also be remembered that each bank has a different Swift code. Therefore, you need to pay attention and recheck whether the Swift code you entered is correct according to the bank or not.