How to Send Money to Andorra

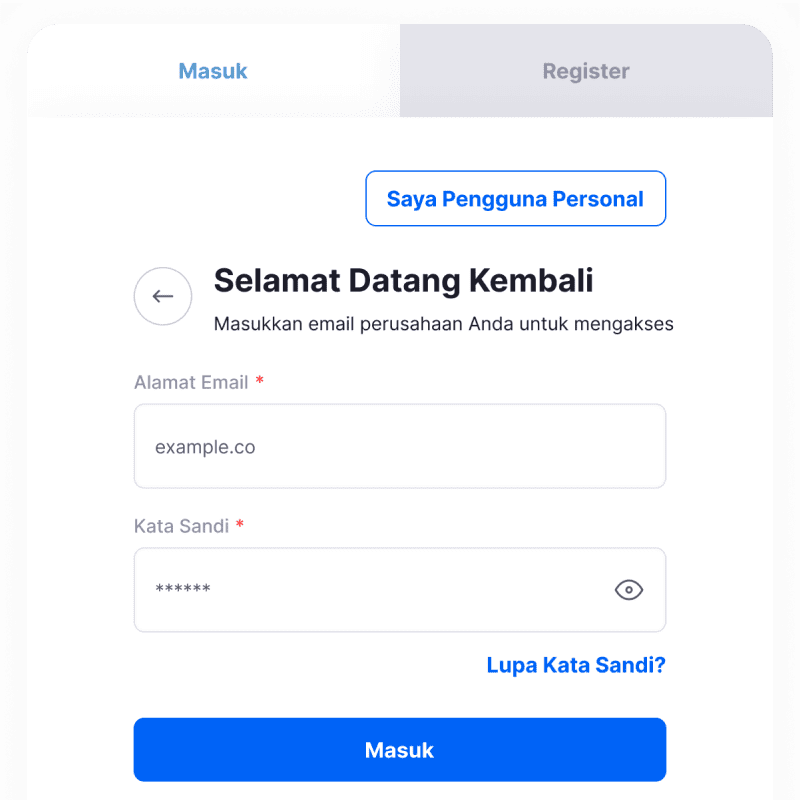

1. Login with your account.

Visit the Easylink page, then click on Login and enter your email/phone number along with your password.

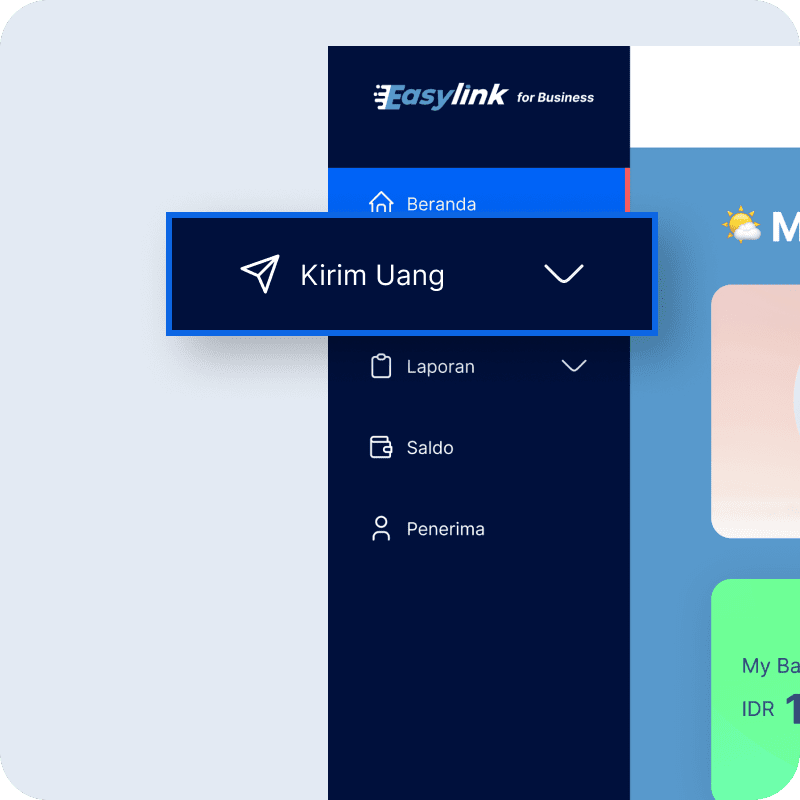

2. Choose the Destination Currency

After logging in, click "Send Money" on the left side of the screen, then select your target currency.

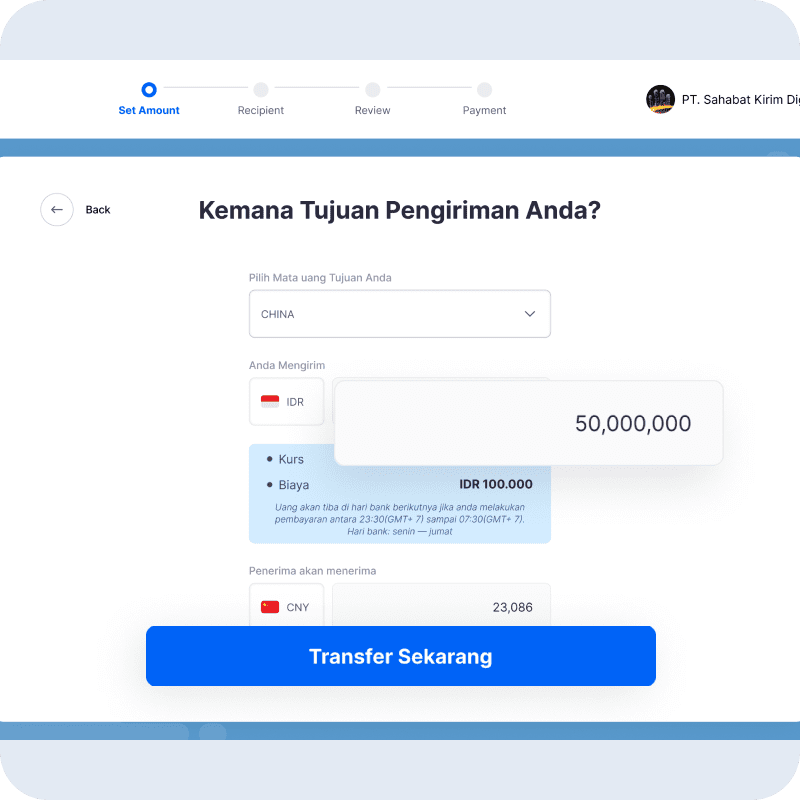

3. Specify the Amount and Complete the Transfer

Enter the amount you want to send, then click ''Transfer Now''.

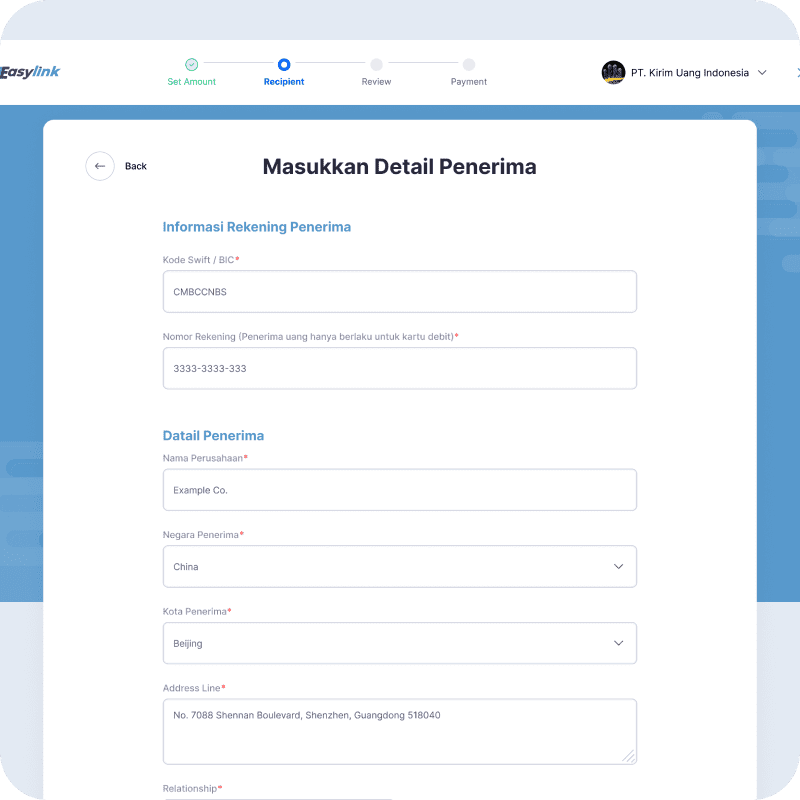

4. Enter Recipient Details

Click ''Add Recipient'' and complete the recipient's information if it's not already available.

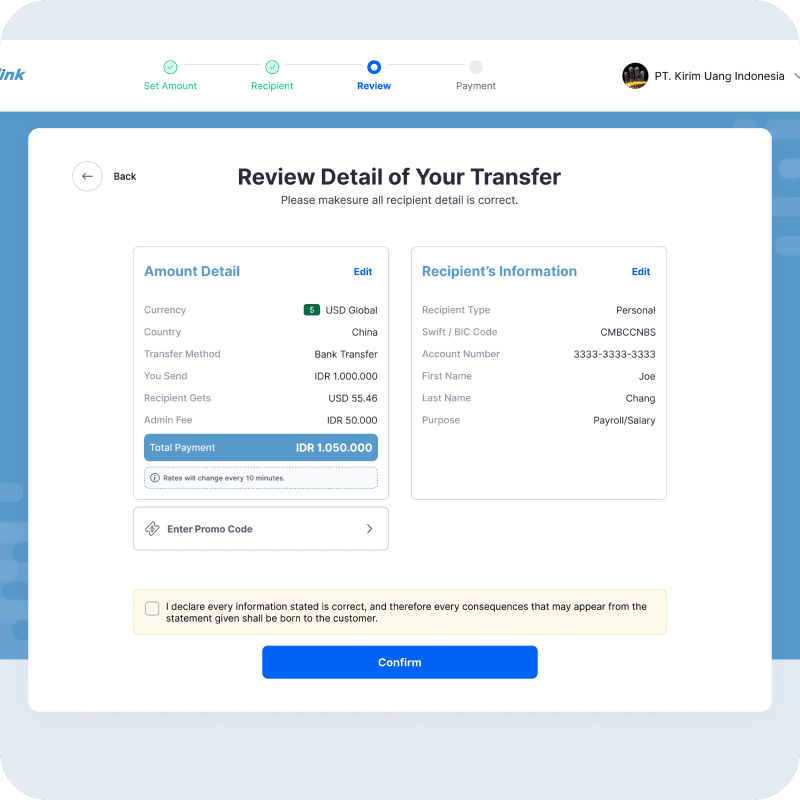

5. Confirm Recipient Information

Double-check the recipient's fund details you've entered.

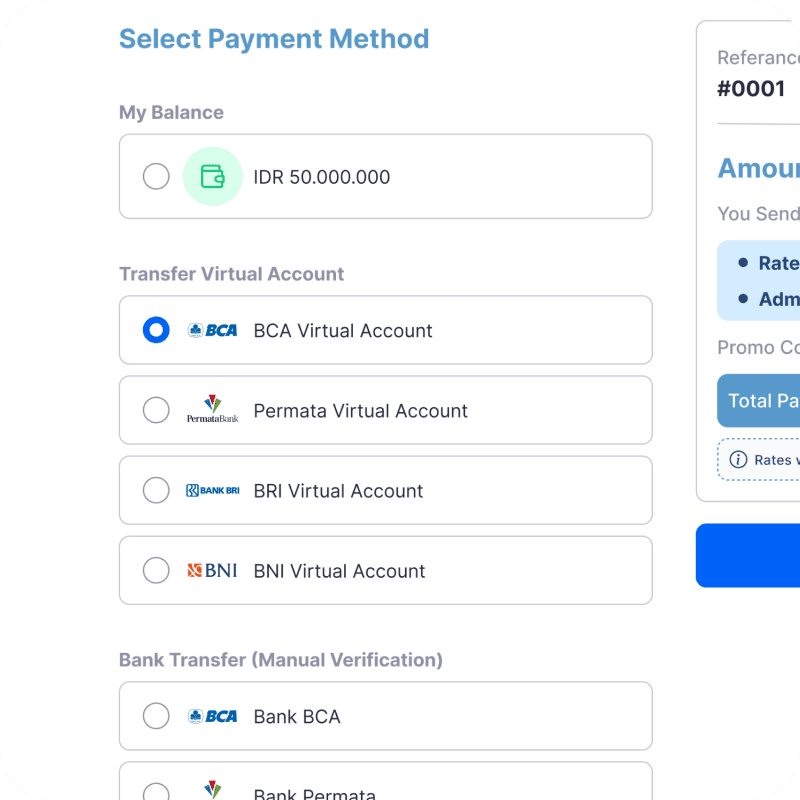

6. Select Payment Method

Choose your preferred payment method, then click ''Continue''.

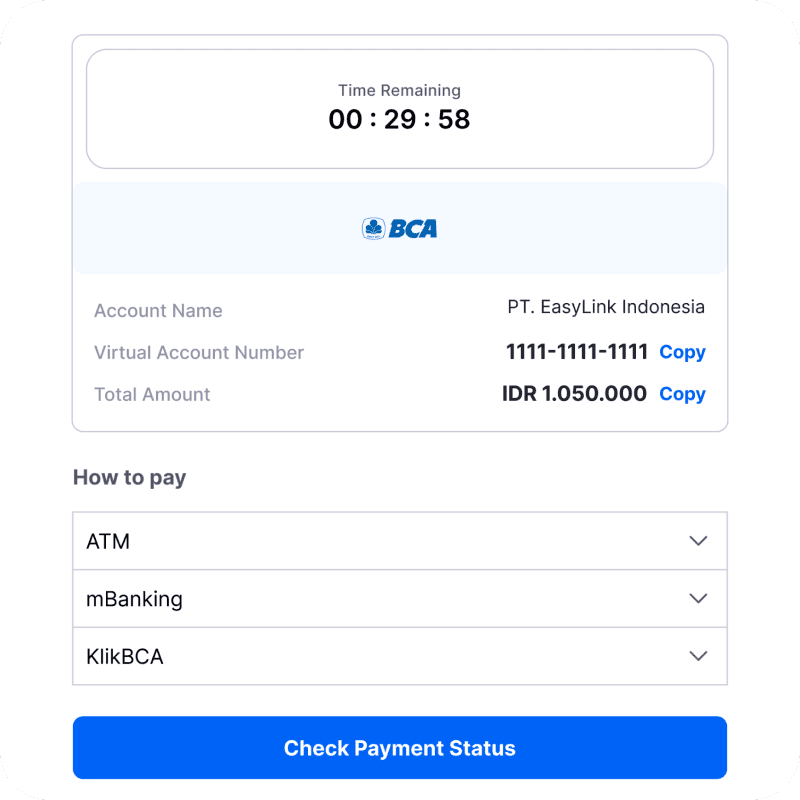

7. Complete the Payment

Please make the payment as per the specified timeframe.

8. Done!

You have successfully sent money using Easylink 🚀.

Why Choose Easylink?

The Key to International Money Transfers

Simplifying Money Transfers

Faster than ever

With Just 5 Documents

Choose Your Payment Method!

How Much Does It Cost To Transfer IDR to USD?

To Send from Rupiah to United States Dollar in IDR to USD, you only pay an admin fee of Rp. 250,000. No matter how much money you send, the transaction fee remains the same.

Fixed Transfer Fee Only Rp.250,000

There are no additional costs.

Easylink can transfer in more than 170+ Countries and 29 Local Currencies

-

Aruba

Aruba

-

Algeria

Algeria

-

Angola

Angola

-

Andorra

Andorra

-

United Arab Emirates

United Arab Emirates

-

Argentina

Argentina

-

Armenia

Armenia

-

Australia

Australia

-

Austria

Austria

-

Azerbaijan

Azerbaijan

-

Bahamas

Bahamas

-

Bahrain

Bahrain

-

Bangladesh

Bangladesh

-

Barbados

Barbados

-

Belgium

Belgium

-

Belize

Belize

-

Benin

Benin

-

Bhutan

Bhutan

-

Bolivia

Bolivia

-

Botswana

Botswana

-

Brazil

Brazil

-

British Virgin Islands

British Virgin Islands

-

Brunei Darussalam

Brunei Darussalam

-

Bulgaria

Bulgaria

-

Burkina Faso

Burkina Faso

-

China

China

-

Kanada

Kanada

-

Cape Verde

Cape Verde

-

Cayman Islands

Cayman Islands

-

Chad

Chad

-

Chile

Chile

-

Kolombia

Kolombia

-

Comoros

Comoros

-

Congo

Congo

-

Kosta Rika

Kosta Rika

-

Pantai Gading

Pantai Gading

-

Curaçao

Curaçao

-

Cyprus

Cyprus

-

Republik Ceko

Republik Ceko

-

Kamerun

Kamerun

-

Denmark

Denmark

-

Djibouti

Djibouti

-

Dominica

Dominica

-

Republik Dominika

Republik Dominika

-

Ecuador

Ecuador

-

Mesir

Mesir

-

El Salvador

El Salvador

-

Estonia

Estonia

-

Eswatini

Eswatini

-

Ethiopia

Ethiopia

-

Falkland Islands (Malvinas)

Falkland Islands (Malvinas)

-

Finlandia

Finlandia

-

Prancis

Prancis

-

French Guiana

French Guiana

-

Gabon

Gabon

-

Gambia

Gambia

-

Georgia

Georgia

-

Jerman

Jerman

-

Ghana

Ghana

-

Gibraltar

Gibraltar

-

Yunani

Yunani

-

Grenada

Grenada

-

Guatemala

Guatemala

-

Guernsey

Guernsey

-

Guinea

Guinea

-

Guinea-Bissau

Guinea-Bissau

-

Guyana

Guyana

-

Haiti

Haiti

-

Honduras

Honduras

-

Hong Kong China

Hong Kong China

-

Hongaria

Hongaria

-

Iceland

Iceland

-

India

India

-

Irlandia

Irlandia

-

Isle of Man

Isle of Man

-

Israel

Israel

-

Italia

Italia

-

Jamaica

Jamaica

-

Jersey

Jersey

-

Japan

Japan

-

Jordan

Jordan

-

Kazakhstan

Kazakhstan

-

Kenya

Kenya

-

Kamboja

Kamboja

-

Kuwait

Kuwait

-

Kroasia

Kroasia

-

Kyrgyzstan

Kyrgyzstan

-

Laos

Laos

-

Latvia

Latvia

-

Lesotho

Lesotho

-

Liberia

Liberia

-

Liechtenstein

Liechtenstein

-

Lithuania

Lithuania

-

Luxembourg

Luxembourg

-

Macau China

Macau China

-

Madagascar

Madagascar

-

Malawi

Malawi

-

Malaysia

Malaysia

-

Maldives

Maldives

-

Mali

Mali

-

Malta

Malta

-

Mauritania

Mauritania

-

Mauritius

Mauritius

-

Mayotte

Mayotte

-

Mexico

Mexico

-

Moldova

Moldova

-

Monaco

Monaco

-

Mongolia

Mongolia

-

Morocco

Morocco

-

Mozambik

Mozambik

-

Namibia

Namibia

-

Nepal

Nepal

-

Netherlands

Netherlands

-

New Zealand

New Zealand

-

Solomon

Solomon

-

Niger

Niger

-

Nigeria

Nigeria

-

Northern Mariana Islands

Northern Mariana Islands

-

Norwegia

Norwegia

-

Oman

Oman

-

Pakistan

Pakistan

-

Panama

Panama

-

Papua Nugini

Papua Nugini

-

Paraguay

Paraguay

-

Peru

Peru

-

Philippines

Philippines

-

Polandia

Polandia

-

Portugal

Portugal

-

Qatar

Qatar

-

Rumania

Rumania

-

Rwanda

Rwanda

-

Saint Barthélemy

Saint Barthélemy

-

Saint Lucia

Saint Lucia

-

Saint Martin (French part)

Saint Martin (French part)

-

Saint Pierre and Miquelon

Saint Pierre and Miquelon

-

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines

-

San Marino

San Marino

-

Sao Tome and Principe

Sao Tome and Principe

-

Arab Saudi

Arab Saudi

-

Senegal

Senegal

-

Seychelles

Seychelles

-

Sierra Leone

Sierra Leone

-

Singapore

Singapore

-

Slovakia

Slovakia

-

Slovenia

Slovenia

-

South Africa

South Africa

-

South Korea

South Korea

-

Spanyol

Spanyol

-

Sri Lanka

Sri Lanka

-

Suriname

Suriname

-

Swedia

Swedia

-

Swiss

Swiss

-

Taiwan

Taiwan

-

Tajikistan

Tajikistan

-

Tanzania

Tanzania

-

Thailand

Thailand

-

Timor Leste

Timor Leste

-

Togo

Togo

-

Trinidad and Tobago

Trinidad and Tobago

-

Tunisia

Tunisia

-

Turkey

Turkey

-

Turkmenistan

Turkmenistan

-

Uganda

Uganda

-

United Kingdom

United Kingdom

-

Amerika Serikat

Amerika Serikat

-

Uruguay

Uruguay

-

Uzbekistan

Uzbekistan

-

Vanuatu

Vanuatu

-

Vietnam

Vietnam

-

Zambia

Zambia

Testimonials

Easylink FAQ

Easylink is licensed and supervised by Bank Indonesia, so transactions via Easylink are guaranteed to be safe.

Select the recipient, enter the desired amount, and follow our simple guide to safely, quickly, and easily complete the money transfer process.

Sending money abroad is the process of transferring funds from one country to an account or financial institution in another country, for your needs such as shopping, paying tuition, and other purposes.

Currently, Easylink supports international money transfers to countries including Singapore, Malaysia, China, India, the Philippines, Thailand, South Korea, Japan, the United Kingdom, and 170+ other countries.

For the limit or maximum transfer amount, it may vary depending on the country you are sending to Customer Service for more information.

Transfer times vary but generally range from a few hours to one business day.

We ensure total transparency in fees. Fee information will be clearly displayed before confirming the transfer.

Yes, Easylink's tracking feature allows you to monitor the real-time status of your money transfer.

Associated fees are clearly displayed before confirming the transfer. No hidden fees.

Simple registration with personal information and a bank account is all that's required to start using Easylink.

The documents required for international money transfers include:

- Invoice

- Agreement

- Contract

- Bill of lending

- Shipping Manifest

Contact our 24/7 customer service for assistance with any problems or questions.

For international money transfers, you need a Swift code or BIC number. A Swift code is a format used to identify banking and securities institutions located in a specific country or branch. To obtain the SWIFT code, confirm with the receiving bank.